If we talk about trading platforms then there are thousands of online platforms available for trading so why do traders need to prefer the cTrader platform? A few features make a platform unique from others. cTrader is a full-featured trading platform that provides a number of special features that make it the best option for every trader as well as for experienced traders. Different prop firms also prefer to provide cTrader to their traders. Let’s discuss some important features of the cTrader platform that are important to understand for each trader to make the right decision.

What is cTrader?

cTrader was developed by Spotware in 2010 and then it became one of the biggest competitors of MetaTrader’s series of trading platforms. This platform provides many financial instruments like indices, commodities, FX, and cryptocurrencies along with a customized interface and other features. It is the greatest alternative for scalpers as well as day traders and swing traders and is made for both new and experienced traders making it more suitable than other platforms.

Features of cTrader

Advanced Charting Tools

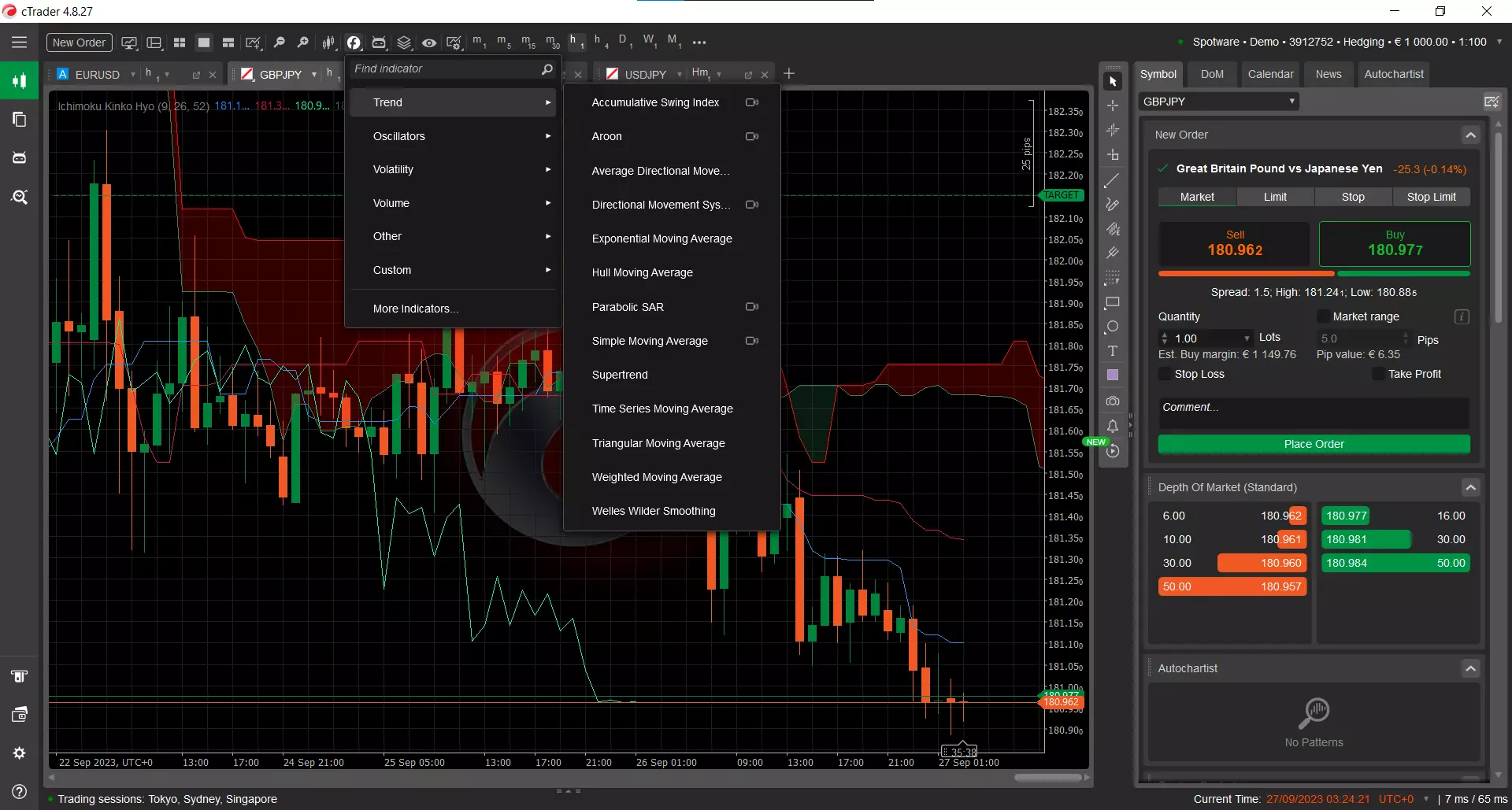

The charting tool is a part of helping traders in using charts to complete their technical analysis. The cTrader platform provides this feature as well as a number of different chart types like line, bar, and candlestick charts. According to these multiple chart layouts, all traders can analyze market trends more effectively. cTrader also helps users design custom timeframes to perform detailed technical analysis by supporting different types of timeframes.

cTrader has an extensive collection of custom indicators and drawing tools to improve its charting powers. Traders can utilize a number of indicators like MACD, Bollinger Bands, and moving averages to identify trading opportunities. Not only that but users can also design and import their own indicators to maximize their trading strategy.

Automated Trading with cAlgo

cTrader also provides algorithmic trading with cAlgo which is an integrated development environment (IDE). Traders can use the C# programming language to develop and execute automated trading strategies due to this connectivity which is why cTrader and cAlgo work so well together. Traders can use cAlgo to adjust parameters and execute their algorithms in real-time by back-testing their strategies against historical data using the same platform.

Experienced traders can design advanced trading robots and specific indicators with the help of cTrader Automate API. This API gives traders huge flexibility and control over automated trading strategies by allowing them to get market data, account information, and trading features directly.

Enhanced Order Execution

The way cTrader manages orders is one of its most preferred benefits. Among these order types, there are different order types available on the platform like market limit, stop, and trailing stop orders. One-click trading and complex order management features are also available like trade separation and incomplete fills help traders execute trades even more quickly and profitably.

cTrader also provides traders with Level II pricing tools that provide them with additional market knowledge. This tool helps traders to analyze the whole range of execution prices directly from liquidity providers giving them a better understanding of the market’s depth and enabling them to make informed trading choices. The transparency provided by Level II pricing improves overall trade.

Comprehensive Risk Management Tools

Effective risk management is important for trading and cTrader is unique in this area by providing a broad range of risk management tools. With the help of these tools, traders can accurately set stop-loss and take-profit levels and track exposure with margin level and account equity in real-time.

One of cTrader’s advanced protection features is the power to set up multiple take-profit targets. It can be used to close positions and activate alerts when it meets a specific limit. These characteristics enable traders to take proactive steps to manage risks and protect their money.

cTrader Copy

An innovative social trading tool called cTrader copy helps traders copy the strategies of professional traders. This feature is beneficial for beginner traders who want to learn from experts or for those who prefer a hands-off approach to trading. cTrader copy helps users choose carefully the traders that want to follow by giving customers complete performance data for strategy providers.

Traders can customize their copy settings according to their trading goals and risk tolerance. Users can change trade size, take-profit levels, and stop-loss to customize their copying experience.

Pricing Options

Pricing is one important consideration for many people but cTrader is totally free which helps traders to reduce stress. Even this platform provides its features and services without charging anything. Now, it’s important to understand that cTrader is free but some firms charge fees and have different pricing structures. You must carefully check the firm’s prices with their charge schedule business plan and other provides to eliminate any doubt.